ABOUT US

Chairman’s Message

Our Association is an organization of Type II Financial Instruments Business Operators that handle trust beneficiary rights and funds (“Type II Funds”). It is certified by the Prime Minister as a Self-Regulatory Organization (Certified Financial Instruments Firms Association) under the Financial Instruments and Exchange Act (FIEA).

A wide range of industries—including securities, banking, leasing, real estate, and construction—are engaged in Type II Financial Instruments Business operations.

Currently, the Association has approximately 660 corporate members.

The financial instruments that are handled by Type II Financial Instruments Business Operators are categorized as alternative assets, as opposed to traditional financial assets such as stocks and bonds. Trust beneficiary rights are used for real estate transactions and asset securitization, while funds provide financing not only for investment businesses, but also for a wide range of initiatives, including start-ups, innovation-driven ventures, regional revitalization projects based on empathy and support, and SDGs-related activities.

In line with the policy objective of shifting “from savings to investment” and the growing importance of becoming an “investment-oriented nation” that attracts domestic and international investment, including in regional areas, the Association will continue its unwavering efforts to protect investors through self-regulatory rules and guidance for business operators. The Association will also strive to ensure that Type II Financial Instruments Business can contribute to smooth financial intermediation and asset building for the public.

HIBINO Takashi

Chairman and CEO

HIBINO Takashi

Chairman and CEO

Profile

- Name

- Type II Financial Instruments Firms Association

(Ippan-Shadan-Houjin Dainishu-Kinyu-Shouhin-Torihikigyou-Kyoukai) - Chairman and

CEO - HIBINO Takashi

- Office

- 2-11-2, Nihombashi, Chuo-ku, Tokyo

103-0027 JAPAN

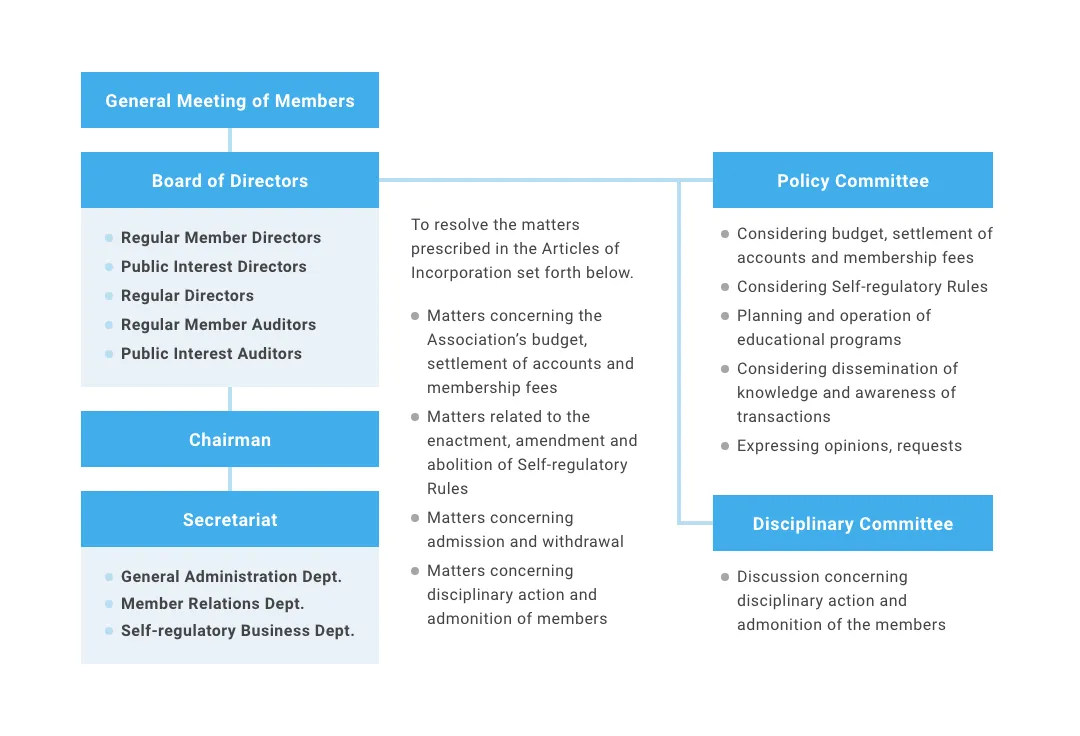

Organization

Board of Directors and Policy Committee Members

History

| T2FIFA | FIEA | |

|---|---|---|

| 2007 | The Financial Instruments and Exchange Act (FIEA), a comprehensive overhaul of the former Securities and Exchange Act, was enforced. | |

| 2010 | T2FIFA established. | |

| 2011 | The Prime Minister certified T2FIFA as a Financial Instruments Firms Association. | |

| 2012 | T2FIFA started member education. | |

| 2015 | Amended FIEA provided measures for increasing T2FIFA members business. | |

| 2018 | SDGs Promotion Working Group established. | |

| 2019 | SDGs Promotion Working Group Report was published. | |

| 2020 | T2FIFA starts remote education for members. | |

| 2022 | T2FIFA notification net system started operation. | |

| 2024 | Website redesigned. |

Members

As of end of March 2025, there are 662 Regular Members, and 8 Supporting Members.

Regular Member

Either a Financial Instruments Business Operator or a Registered Financial Institution which performs Self-Offering and Other Transactions, etc. as business and has obtained the approval by the Board of Directors.

Electronic Public Offering Member

A Type II Small-Amount Electronic Public Offering Service Provider which has obtained the approval by the Board of Directors.

Supporting Member

A person that supports the activities of the Association and has been approved by the Association.

Working to Promote SDGs

The SDGs Promotion Working Group established under the Board of Directors published its report.

Logo & Illustration

Logo concept

The two diagonal lines mean II; their thickness getting thicker as they go to the upper right means growth and progress; the circle means the rising sun.

Concept of the illustration

The illustration expresses that seeds called trust beneficiary rights or funds planted by Type II Financial Instruments Business operators bear fruit in fields such as finance, real estate, energy, infrastructure, logistics, medical care and agriculture.

What is the Type II Financial Instruments?

Article 2, Paragraph 2 of FIEA defines the following rights as Type II Financial Instruments.

Even if they are not rights which must be indicated on instruments or certificates, they are deemed as Securities; therefore, they are called ‘deemed securities.’

The rights prescribed in (v) are so called collective investment scheme interests (shudan-toshi scheme mochibun).

(i) beneficial interest of a trust (shintaku juekiken);

(ii) rights that are claimable against a foreign person and which have the nature of the rights specified in the preceding item;

(iii) the membership rights of a general partnership company or limited partnership company

(limited to rights specified by Cabinet Order), membership rights of a limited liability company;

(iv) the membership rights of a foreign corporation which have the nature of the rights specified in the preceding item;

(v) among the rights based on a partnership contract provided for in Article 667, paragraph 1 of the Civil Code, a silent partnership agreement provided for in Article 535 of the Commercial Code, a limited partnership agreement for investment provided for in Article 3, paragraph 1 of the Limited Partnership Act for Investment, or a limited liability partnership agreement provided for in Article 3, paragraph 1 of the Limited Liability Partnership Act, membership rights in an incorporated association or other rights (excluding rights based on foreign laws and regulations) the holder of which can receive dividends from profits arising from business that is conducted using the money (including anything specified by Cabinet Order as being similar to money) invested or contributed by the equity holder or a distribution of the assets of the invested business. (Item (v) from (a) to (c) of said paragraph are exceptions.)

(vi) rights based on laws and regulations of a Foreign State which are similar to those specified in the preceding item;

(vii) securities specified by Cabinet Order

Article 2, Paragraph 3 of the FIEA defines Paragraph 2 Securities. They are the above-mentioned “Deemed Securities” excluding electronically recorded transferable rights with high liquidity.

What is the Type II Financial Instruments Business?

Type II Financial Instruments Business is provided for in Article 28, Paragraph 2 of the FIEA. The term “Type II Financial Instruments Business” means self-offering related to collective investment scheme interests etc. and conducting any of the following acts related to Type II Financial Instruments.

(i) sale and purchase of Securities

(ii) intermediary, brokerage

(iii) dealing in Public Offering or Secondary Distribution of Securities or dealing in Private Placement of Securities;

Type II Financial Instruments Business shall be conducted only by persons and companies registered by the Prime Minister